RIP Polyvore You Would've Loved the Fashion Tech 2.0 Era

Key differences between Fashion Tech 1.0 versus Fashion Tech 2.0

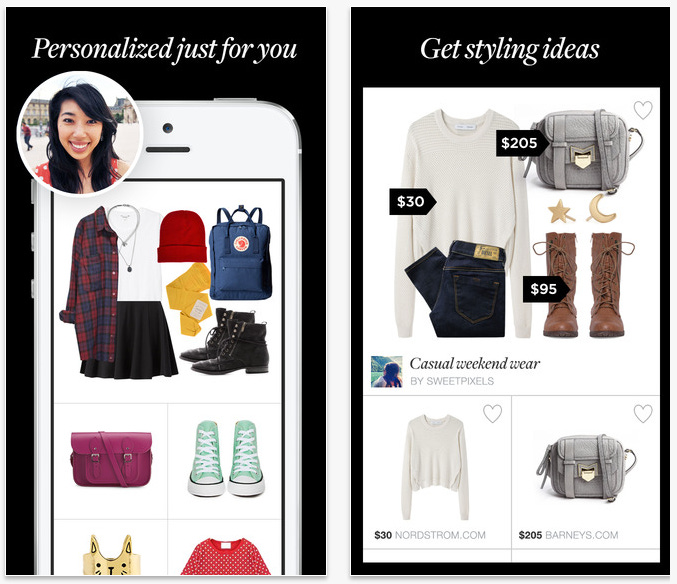

If you were online in the early 2010s, you probably remember Polyvore. It was the equivalent of a digital playground for dream closets and moodboard addicts. You could drag-and-drop Prada boots next to a Zara skirt, add a lipstick swatch, and build an outfit collage that looked straight out of a glossy magazine.

I remember in middle school spending hours on this site dreaming up outfits I’d wear once I had a paycheck. Then one day, it was gone. Acquired by Ssense in 2018, Polyvore quietly vanished, leaving millions of us stranded mid-moodboard.

Polyvore’s disappearance feels symbolic of Fashion Tech 1.0: a wave of innovation that digitized fashion but rarely made it truly personal. It was a time of online storefronts, just-in-time production, and early optimization—tools built to make fashion faster, cheaper, more searchable. But the space was missing something deeper: creativity, connection, and cultural nuance.

Today, we’re entering Fashion Tech 2.0, and the energy feels different. Instead of streamlining logistics, startups are reimaginging how fashion is designed, discovered, and experienced. Think AI-powered styling, digital garments rendered in 3D, and communities built around niche aesthetics. The new wave blends art, data, and identity.

Fashion Tech 1.0 → Streamline & Scale

Timeline: 2008-2018

Core Objective: Efficiency & Accessibility

Market Dynamics:

Fashion Tech 1.0 coincided with the rise of fast fashion and DTC retail. Companies like Zara, ASOS, and early Shopify brands utilized digital channels to shorten time-to-market and expand reach. It marked the industry’s first wave of digital transformation, where e-commerce and social media introduced accessibility, scale, and visibility. The focus was on digitization — getting brands online, enabling global logistics, and leveraging influencer marketing to reach new audiences. Innovation centered on the process rather than the product experience, and technology served commerce, not creativity. Sustainability and regulation were secondary concerns, as rapid growth and convenience took precedence over accountability.

Business Focus:

Inventory Optimization: Reduce overproduction through demand-aligned manufacturing

E-commerce Enablement: Build online storefronts with basic search functionality

Manufacturing Systems: Adopt just-in-time production models to minimize holding costs

Design: Remained largely analog; digital tools supported production, not ideation

Key Players: Depop, Asos, Instagram, Amazon Fashion, RTR

Limitations:

Search-first interfaces flattened discovery; shopping remained transactional

Lack of personalization and emotional engagement limited differentiation

Technology adoption prioritized logistics over consumer insight

Fashion Tech 2.0 → Integrating Intelligence

Timeline: 2020-now

Core Objective: Experience & Adaptability

Market Dynamics:

Fashion Tech 2.0 companies sit at the intersection of design intelligence and consumer data. Emerging from regulatory scrutiny, climate urgency, and shifting consumer behavior, this era blends innovation with accountability; it represents a more mature, values-driven phase. It’s defined by data ethics, circular design, AI-driven personalization, and the integration of sustainability into core business models.

Their differentiator is not just presence online, but the ability to anticipate and adapt, whether that’s through real-time trend tracking or AI-assisted curation. The focus has shifted from digital expansion to responsible innovation—using technology to enhance transparency, reduce waste, and build community trust.

Where 1.0 was about disruption, 2.0 is about balance and long-term resilience.

Business Focus:

Digital Design: 3D tools and virtual sampling now inform creative direction and production, reducing time-to-market and waste

Personalization: AI-powered recommendations tailor experiences to user preferences and past behavior

Community Targeting: Brands design for niche audiences (e.g., vintage enthusiasts, luxury consumers) instead of mass markets

Data & AI: Predictive analytics and generative tools inform design, trend forecasting, and inventory planning

Sustainability: Circular production systems and on-demand models align with regulatory and consumer pressure

Influencer Integration: Creator-led distribution channels replace traditional merchandising hierarchies

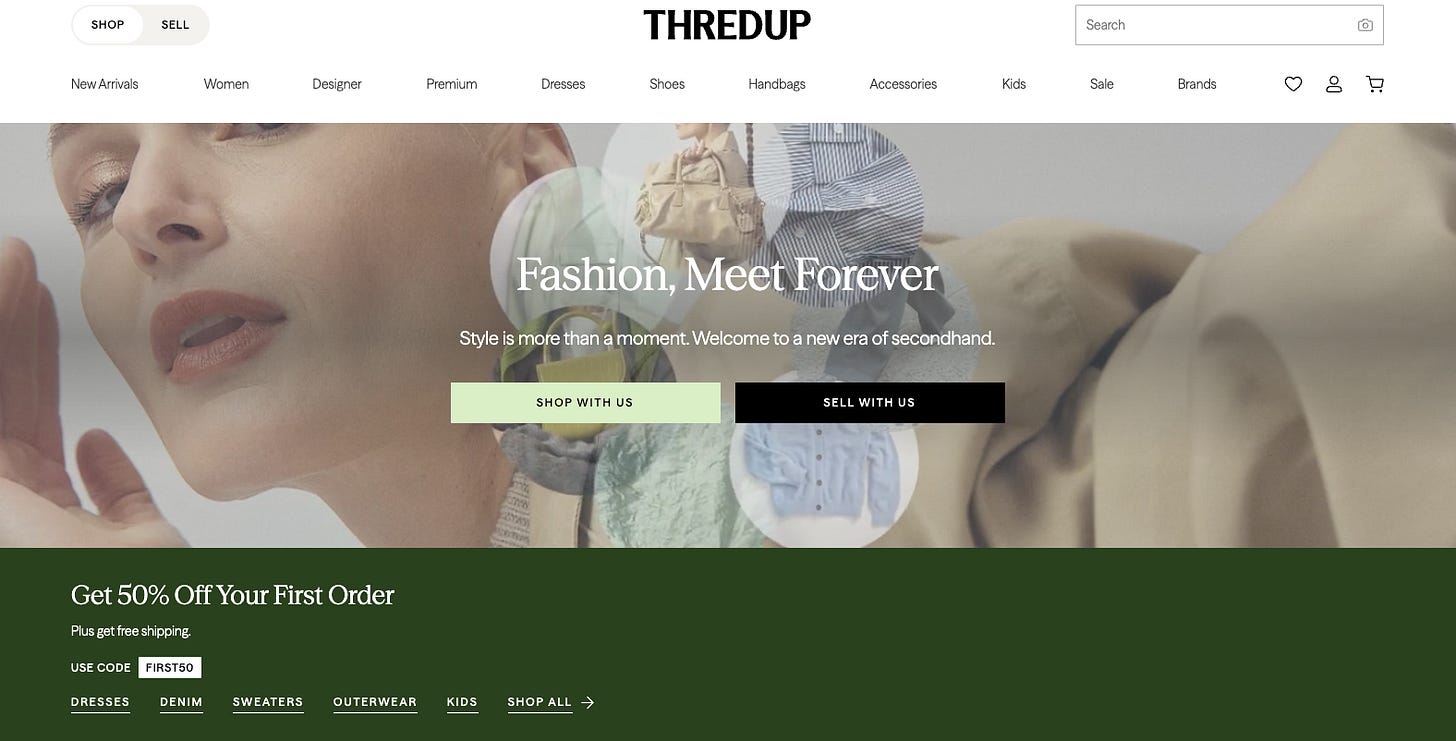

Key Players: ThredUp, Vestiaire Collective, Lyst, TheRealReal

Challenges:

Personalization at scale increases operational complexity

Heavy reliance on data quality and technical talent

Questions around market size—mass adoption vs. niche engagement

Investor Landscape: From E-Commerce to Engineering

During Fashion Tech 1.0, investor capital often flowed to consumer-facing brands positioned as “tech” companies, even when their innovation was limited to online retail. DTC brands positioned themselves as tech companies because they sold goods online, but there was nothing really revolutionary about them listing products on a website.

*cough* Glossier *cough*

Today, that model no longer attracts capital. With AI’s re-emergence, venture interest has shifted toward founders with technical roadmaps and engineering fluency, not just branding prowess.

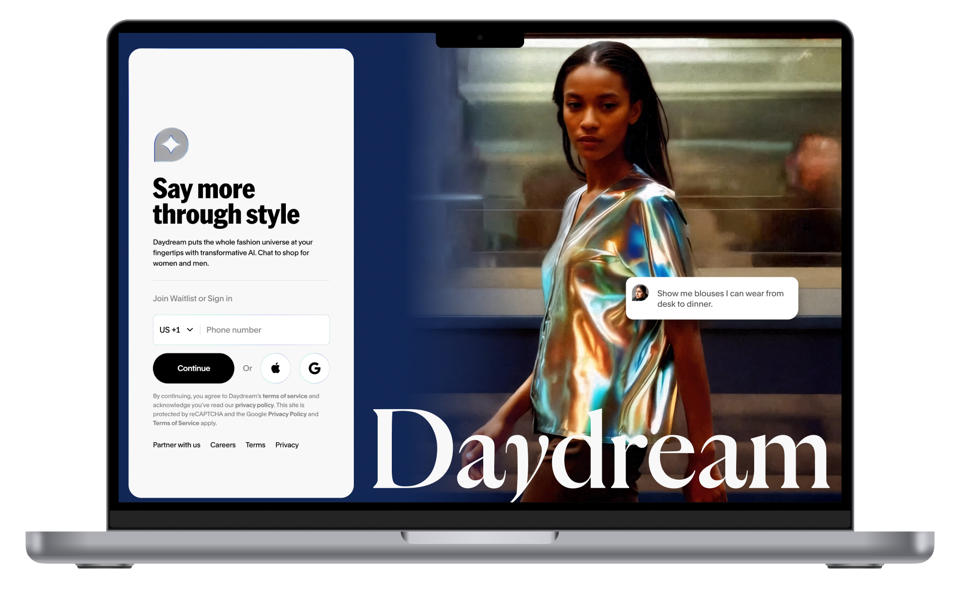

Startups like Daydream are positioning themselves as “ChatGPT for fashion” that uses AI to power personalized search and curation. But adoption risk remains: personalized platforms may appeal deeply to some users, but the addressable audience size is still unproven.

Investor Priorities (2.0):

Proprietary technology or defensible data advantage

Founders with technical experience

Scalable personalization without unsustainable overhead

Integration of sustainability and compliance from day one

Thanks for reading!

Want a Career in the Fashion & Social Commerce Space? Start here! The Restitiched Job Board is your dedicated hub for jobs, gigs, & internships across fashion, fashion tech, social commerce, and resale! Designed for early career professionals in the marketing, design, & content creation space.

🔒 Paid subscribers get access to the full job board, updated every week.

Access the Ultimate Guide to Reselling on Depop Here (for paying subscribers only).

Be Sure to follow on IG @restitiched.substack & on TikTok @restitiched.co for the latest updates <3